Even before COVID-19, many North Carolina renters were struggling with housing instability due to the state’s housing affordability crisis. According to 2019 US Census Bureau data, 45% of renter households in North Carolina (623,000 households) lacked access to an affordable home. That figure was even more dire for households with low incomes and people of color. Four in five renter households below 50% of the area median income (430,000 households) were in housing that cost more than 30% of their income. Likewise, 39% of Black, Indigenous, People of Color (BIPOC) renter households were similarly cost-burdened compared to 25% of white, non-Hispanic renter households (1).

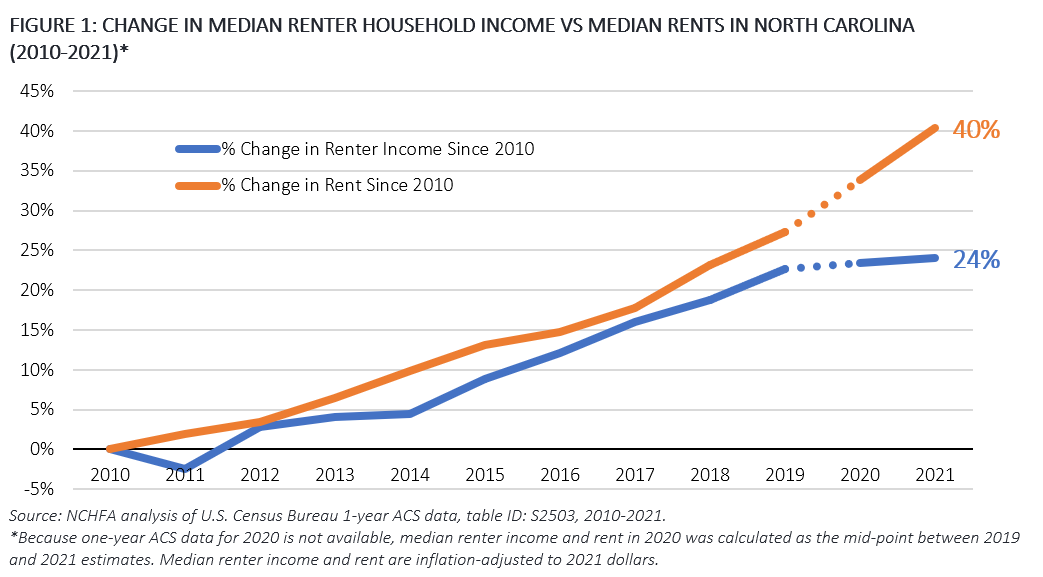

Pandemic-related economic insecurity, displacement and rapid rent increases have only exacerbated this unaffordability and have undermined previous efforts to relieve the housing crisis. According to the Harvard Joint Center for Housing’s 2022 State of the Nation’s Housing report, apartment rents were up 16% nationally in the first quarter of 2022 from a year earlier, with increases in North Carolina’s metro areas approaching 20%. Even as the median income increased for North Carolina renter households in recent years, the gap between median renter income and median rent has persisted and widened during the pandemic. As shown below in Figure 1, there has been steady growth in median renter incomes since 2012, but rents have grown at an even faster pace. Adjusted for inflation, median renter income has grown 24% since 2010, while median rent has increased 40%. This disparity has placed increasing pressure on renter households, leading to high numbers of cost-burdened households in the state (2).

Rent-restricted and income-restricted housing is an important tool in addressing this increasing gap between rents and incomes. The Low-Income Housing Tax Credit (LIHTC/Housing Credit) is one of North Carolina's strongest—and largest—financing tools for creating and rehabilitating affordable homes for low-income renters across the state. The Housing Credit was first created in 1986 and made permanent in 1993 and operates as an indirect federal subsidy used to finance affordable rental housing in the US. From 1987 to 2022, the Housing Credit has helped create and preserve 109,359 affordable rental homes in 2,530 properties across North Carolina. The benefits of affordable homes financed with the Housing Credit are expansive—from helping low-income families make ends meet to helping promote positive long-term economic, educational and health benefits for residents to generating economic activity in the form of jobs and income for local residents and businesses.

To commemorate the 30th anniversary since the Housing Credit was made permanent by Congress, the Agency recently released a brief but substantive look into the role and impact of the Housing Credit on North Carolina's rental landscape. Check out the 2023 LIHTC Primer on the Agency's website today.

[1] These figures calculate cost burden or when a household is paying more than 30% of household income on housing costs, the industry-accepted definition for housing affordability. Data were derived from 2019 1-year PUMS data.

[2] These figures were derived from US Census Bureau one-year ACS data, table ID: S2503, 2010-2021. Because one-year ACS data for 2020 is not available, median renter income and rent in 2020 was calculated as the mid-point between 2019 and 2021 estimates. Median renter income and rent are inflation adjusted to 2021 dollars.