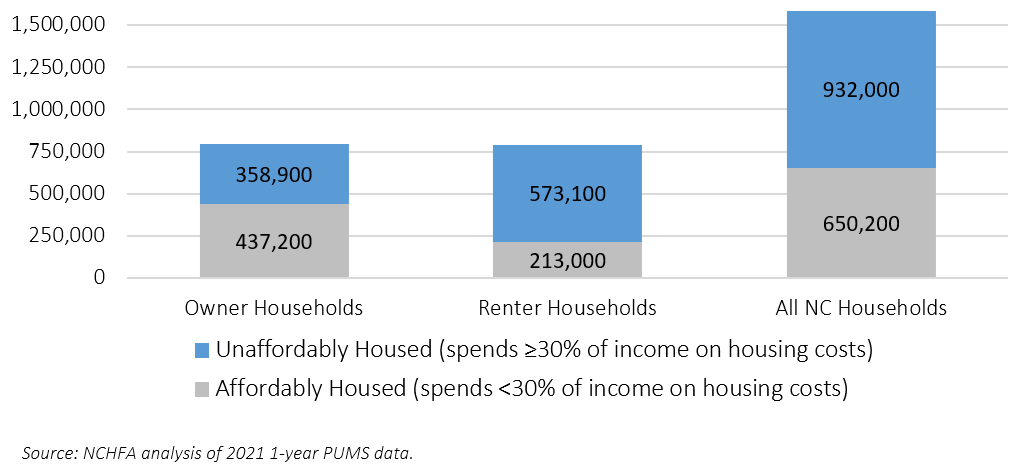

Of the 4.18 million households living in North Carolina, 1.58 million are considered low-income, earning less than 80% of area median income[i] according to recent NC Housing Finance Agency (NCHFA) analysis of the 2021 Public Use Microdata Sample (PUMS), an annual household and housing unit survey conducted by the US Census Bureau.[ii] As shown in Figure 1 below, 932,000 of these low-income households—three out of every five—live in unaffordable housing, defined as housing costs that exceed 30% of their income.[iii] This unaffordability is experienced by both owner and renter households with 45% of low-income owners and 72% of low-income renters living in unaffordable housing.

This unaffordability means low-income households across North Carolina must make difficult choices between putting food on the table, paying for medical care, affording childcare or education or making rent or mortgage payments. Even for those households that manage to find housing that is affordable, many sacrifice housing quality for affordability, which can have serious implications for health and well-being—particularly for children, seniors and people with disabilities. Check out the recent Policy Matters Blog that explored the prevalence of substandard housing in North Carolina in more depth.

FIGURE 1: THREE OUT OF EVERY FIVE LOW-INCOME FAMILIES (932,000) IN NORTH CAROLINA LIVE IN UNAFFORDABLE HOUSING

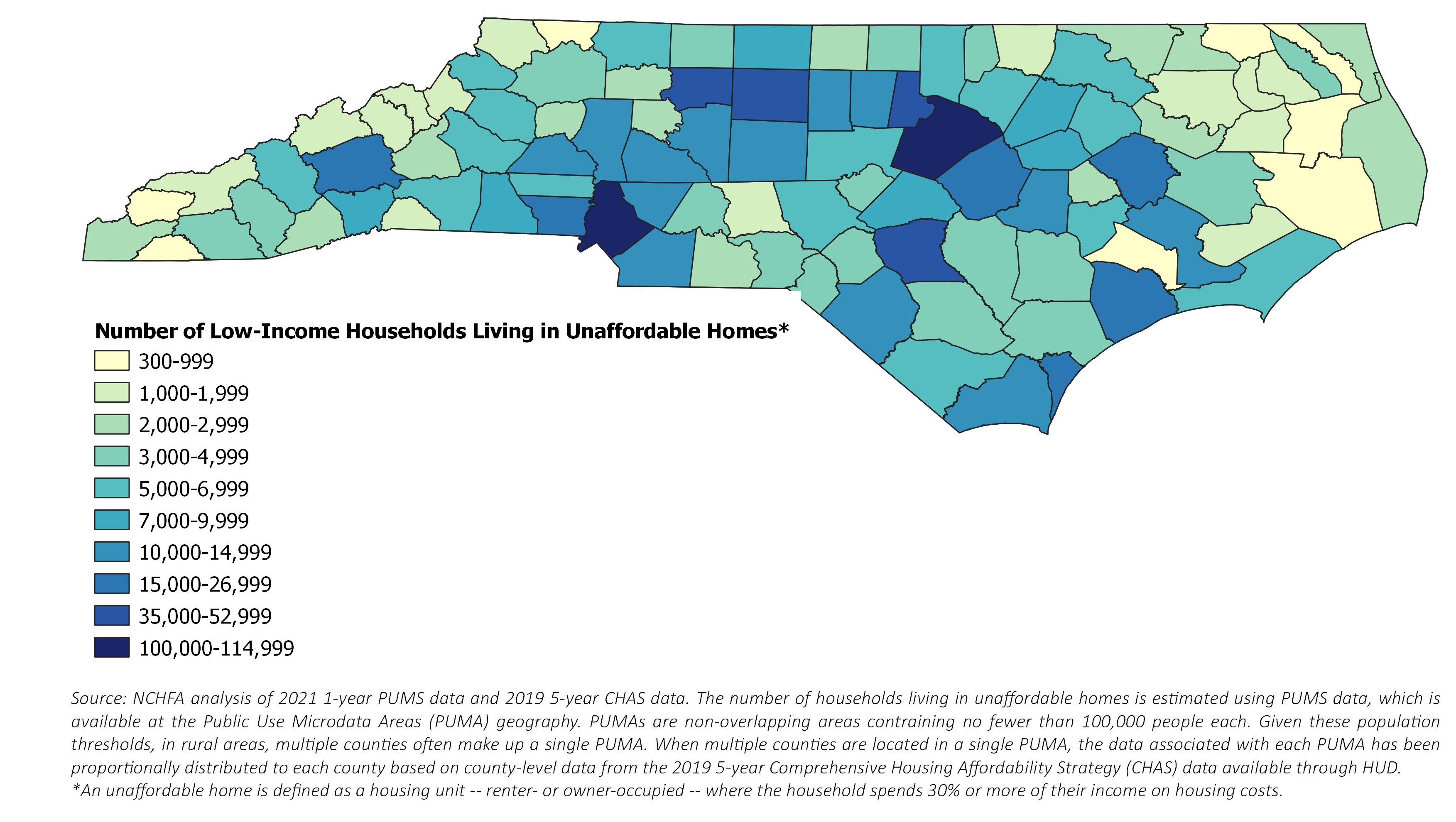

The COVID-19 pandemic only compounded these economic pressures on low-income families in North Carolina. As shown in Figure 2 below, all of North Carolina’s 100 counties struggle with unaffordable housing, with urban and suburban counties holding the highest number of low-income households spending an outsized share of their income on housing. The five counties with the highest number of low-income households living in unaffordable homes are Mecklenburg (114,300), Wake (101,100), Guilford (52,300), Cumberland (37,100), Durham (36,100) and Forsyth (35,900) counties.

FIGURE 2: NUMBER OF LOW-INCOME HOUSEHOLDS LIVING IN UNAFFORDABLE HOMES PER COUNTY

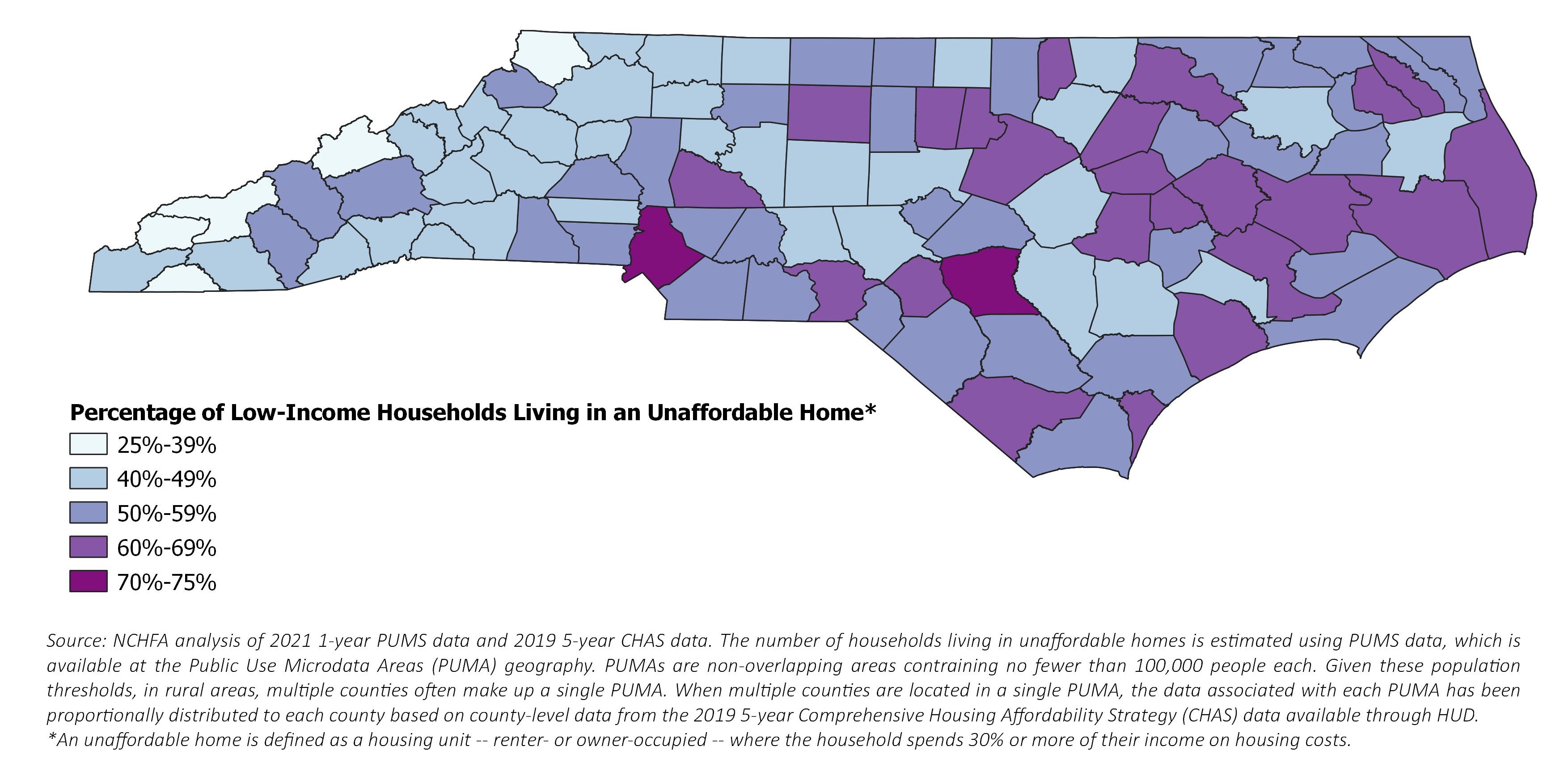

The number of low-income households living in unaffordable housing only represents a part of the story of housing unaffordability across the state. Figure 3 below uses the same analysis of PUMS data and explores the percentage of low-income households in each county that are living in unaffordable housing, showing that while the state’s small, more rural counties might not have a large number of low-income households overall, they do have a large portion of low-income households unable to afford housing. For example, Pasquotank, Hoke, Hyde and seven other counties all have fewer than 4,500 low-income households living in unaffordable housing, but this figure represents 60% or more of low-income households in each county.[iv]

FIGURE 3: PERCENTAGE OF LOW-INCOME HOUSEHOLDS IN EACH COUNTY LIVING IN UNAFFORDABLE HOMES

The large and persistent housing affordability crisis in North Carolina has been well documented by the NC Housing Finance Agency as well as by other housing researchers and policy practitioners throughout the years (see the NC Housing Coalition’s county profiles and UNC Greensboro’s Center for Housing and Community Studies research). The Agency offers an array of financing options designed to help address these very challenges and create more affordable rental and home ownership opportunities for North Carolinians, including rental housing production and preservation, permanent supportive housing, foreclosure prevention assistance and access to housing counseling services, mortgage products, down payment assistance (increased to $15,000 as of April 2023), mortgage credit certificates, repair and rehab financing and community home ownership programs. While this body of research and array of programming demonstrates that progress continues in increasing funding and housing production, we are still far from a North Carolina with stable and affordable housing for households of all incomes.

[i] In 2023, 80% area median income is equivalent to an annual household income of $90,650 for a family of four in Raleigh, $55,350 in Ashe County, and $72,150 in Wilmington. For income limits for all metro areas and counties in North Carolina, see https://www.hudexchange.info/programs/home/home-income-limits/.

[ii] This analysis uses data from the American Community Survey (ACS) Public Use Microdata Sample (PUMS). The ACS is an ongoing, annual survey conducted by the U.S. Census Bureau that collects detailed population and housing data on households throughout the United States. Whereas the ACS aggregates data to a specific geography (state, county, zip code, census tracts, etc.) and releases results only in a pretabulated form, PUMS data is available at the individual and housing unit levels, offering the ability to work directly with the underlying ACS data for more complex analysis.

[iii]A home is considered “affordable” if a household spends no more than 30% of their income on housing costs (rent, mortgage payment, utilities, homeowners insurance, etc.).

[iv] In addition to Pasquotank, Hoke, and Hyde counties, Dare, Perquimans, Greene, Vance, Bladen, Hertford, and Gates all have fewer than 4,500 low-income households living in unaffordable housing and this figure represents 60% or more of low-income households in each county.