A year after the North Carolina Housing Finance Agency blogged about manufactured housing as an affordable and high-quality housing option, the manufactured housing landscape has undergone significant changes.

Federal Update:

Earlier this year, in February, the US Department of Housing and Urban Development (HUD) announced notice of $235 million in competitive grant funding for manufactured housing through the Preservation and Reinvestment Initiative for Community Enhancement (PRICE). Overall, the goals of the PRICE funding are “to maintain, protect, and stabilize manufactured housing and manufactured housing communities.” Applications for this funding were due in July, and HUD has not yet announced awards. More information regarding PRICE may be found through HUD’s PRICE landing page.

HUD also announced updates to the HUD Code. In September, HUD published what it describes as “the most extensive update to the Manufactured Home Construction and Safety Standards in more than three decades.” The goals of these updates, which include 90 substantive changes to the code, are to promote and preserve the quality, durability, safety and affordability of manufactured homes. Some key provisions include improved accessibility standards, modernization of design approaches and materials, enhanced safety and efficiency standards and allowing up to four-unit manufactured homes.

North Carolina Update:

The availability and affordability of manufactured housing continued through 2024. The number of manufactured homes shipped into North Carolina has grown while sales prices have decreased. A previous blog highlighted the increase in manufactured homes being shipped to the state from 2012 through 2022. In 2023, the number of homes shipped to North Carolina—while dipping slightly—remained high at about 5,150 homes. In 2024, however, the number of homes shipped to North Carolina rose significantly—to 3,890 homes in the first seven months alone [i]. Not only is the number of homes shipped higher for each month of 2024 than in 2023, but of the seven months of data available, six are the highest they have been since at least 2012 [ii].

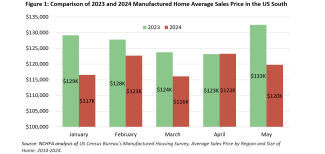

This increase in home shipments coincides with steady—and even decreasing—average sales prices. Based on the most recently available data, in May 2024, the average sales price of a new manufactured home in the South region of the US was $12,700 less than at the same time last year. In general, 2024 prices for the South are about $5,000 less expensive than throughout 2023 [iii].

Looking towards the end of 2024 and into 2025, the need for quality and affordable manufactured homes will continue. Beyond the constant pressure for more affordable housing throughout the state, Hurricane Helene brought with it damage and destruction across large swaths of North Carolina, damaging many homes, both manufactured and stick-built. The state estimates that approximately 126,000 homes are expected to have incurred damage with many of those being single-unit structures, including manufactured homes [iv]. In addition, of the nearly two million housing units within the declared disaster area in North Carolina, more than 200,000 (about 10.3%) are manufactured homes, many of which are occupied by renter-occupied households (about 33%) [v]. Statewide, households in manufactured homes are often lower income with about 68% of renter-occupied households and 52% of owner-occupied having incomes at or below 80% of the area median income [vi].

Manufactured homes may provide a piece of the puzzle in helping house residents after Hurricane Helene. Installation of manufactured homes allows for quicker replacement of housing and is often significantly more affordable. According to the Joint Center for Housing Studies at Harvard University, “[m]anufactured housing construction costs can be as little as 35[%] of an equivalent site-built home”[vii]. Therefore, as a construction method that has both more inherent affordability and speed of construction, manufactured homes offer an opportunity to more quickly and affordably recover for some residents in the aftermath of Hurricane Helene. While meaningfully addressing affordability challenges, older manufactured homes, especially those installed prior to amendments to the HUD Code or other local codes, are often considered unsafe during certain types of natural disasters. While modern standards have vastly improved the safety of manufactured homes, FEMA recommends evacuating manufactured homes during a hurricane or similar disaster[viii].

The North Carolina Housing Finance Agency supports access to quality, affordable manufactured homes through its programs. Through the Agency’s home buyer programs—NC Home Advantage Mortgage™, NC 1st Home Advantage Down Payment, NC Home Advantage Tax Credit and the Community Partners Loan Pool—assistance is provided for purchasing affordable and quality homes, including manufactured homes.

The Agency’s rehabilitation and repair programs—the Essential Single-Family Rehabilitation Loan Pool, Urgent Repair Program and Displacement Prevention Partnership—offer assistance with rehabilitation, modifications and repairs to support low-income homeowners who are facing displacement or inadequate living conditions, including those living in manufactured homes.

Manufactured homes can provide a quality and affordable housing option for residents across the state. The North Carolina Housing Finance Agency assists North Carolinians obtain and maintain a home manufactured or site-built, that they can afford for the long term.

--------

[i] North Carolina Housing Finance Agency analysis of US Census Bureau’s Manufactured Housing Survey, Annual Totals of Shipments to States: 1994-2023. Available here.

[ii] North Carolina Housing Finance Agency analysis of US Census Bureau’s Manufactured Housing Survey, Monthly of Shipments to States by Size of Home: 2000-2024. Available here.

[iii] North Carolina Housing Finance Agency analysis of US Census Bureau’s Manufactured Housing Survey, Average Sales Price by Region and Size of Home: 2014-2024. Available here.

[iv] NC Office of State Budget and Management, Hurricane Damage and Needs Assessment, p. 25. Available here.

[v] North Carolina Housing Finance Agency analysis of US Census Bureau’s American Community Survey data, tables DP04 & B25032, Five-Year Estimates 2018-2022. Available here.

[vi] North Carolina Housing Finance Agency analysis of 2022 1-year PUMS data, not including vacant units. Available here.

[vii] Joint Center for Housing Studies, The State of the Nation’s Housing 2024, p. 5. Harvard University. Available here.

[viii] See, e.g., Federal Emergency Management Agency, Shelter-in-Place for Hurricane, p. 1. Available here.