The cost of housing is up. Across the United States, house prices, monthly rent and homelessness all increased in 2024 according to The State of the Nation’s Housing 2025 report (the Report). Earlier this summer, the Joint Center for Housing Studies at Harvard University (JCHS) published its annual report on the state of housing throughout the country, with focuses on the housing market, home ownership, rental housing, homelessness and future housing challenges. Specifically, the Report identifies record numbers of people experiencing homelessness, record high home prices for buyers and record growth in the number of rental households.

Home Ownership

In 2024, home buying fell to its lowest level in 30 years with national annual home sales falling to 4.06 million homes. This trend makes sense given that home prices have risen 60% since 2019 with a median home price in 2024 of $412,500, home insurance premiums have increased a similar 57% since 2019 (a 14% increase in 2024 alone), property taxes have increased (averaging a 12% increase between 2021 and 2023) and interest rates have remained high (averaging about 7% in 2024).

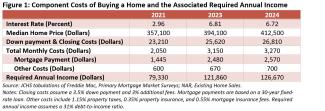

Taken together, this leads to high home buying costs. JCHS reports the average monthly mortgage payment nationwide for a median-priced home in 2024 rose to $2,570 with additional costs of roughly $700 (these costs can include property taxes, property insurance and mortgage insurance). This leads to an average monthly housing payment of about $3,270 for homebuyers, up from about $2,045 in 2021.

In other words, in just three years, the average monthly housing payment for home buyers in the United States rose $1,225. To be able to afford this price, a household would, on average, need an annual income of about $126,670 (see Figure 1 below).

JCHS provides an interactive map showing these figures for specific communities throughout the United States and for about a dozen areas in North Carolina. This map includes regions across the state, many of which have similarly high median home prices and required annual incomes. For example, in the Asheville area, the median home price is $454,500 which requires an annual income of about $134,342, on average to afford. Meanwhile, in eastern North Carolina, in the Wilmington area, the median home price is $463,000 with an associated required income of $142,011.

Not only do these increased costs parallel lessened home buying rates, they also contribute to an increase in cost burden for homeowners. According to the Report, about one in four homeowner households are cost-burdened, meaning the household spends 30% or more of household income on housing costs. This is a yearly increase of more than 640,000 households for a total of over 20 million cost-burdened households. Meanwhile, North Carolina has a slightly lower cost-burden rate for homeowners but still more than 20% of homeowner households in the state are cost burdened. Following these increased costs and cost-burdens, for the first time in 8 years, the national home ownership rate declined in 2024—a trend which has continued into 2025.

Moving forward, the Report expects home prices and monthly payments to continue to rise for current and prospective homeowners. Increases in the costs of construction are expected to continue and JCHS reports that home builders expect recent tariffs to increase the cost of building new single-family homes. Additionally, even for existing homeowners, monthly costs are expected to continue to rise, in part due to higher insurance- and tax-related costs.

Rental Housing

While the narrative around home buying and homeownership is a consistent story of increasing costs and decreased affordability, the nationwide context for rental housing is more nuanced. The Report indicates that some markets have experienced large increases in the cost of rents while others have experienced stagnant or softening rents. While what determines rental prices rental are complex, the balance between available units and number of renters often correlates with where rents increase and where rents remain constant. Areas with supplies keeping up with the rental population generally show less increase and areas where the supply does not keep up generally show higher increases in rent.

Across the country, the number of new rental units constructed continued to rise in 2024, but the number of renter households increased even more. On the one hand, in 2024, about 608,000 new multifamily rental units were added to the housing stock—the largest annual growth in nearly four decades. On the other hand, the renter population has grown even faster.

In 2023, the number of renter households increased by more than 400,000 households and, in 2024, that number more than doubled with an annual increase of nearly 850,000 households, outpacing the development of rental units. This greater increase of renter households compared to creation of units has helped contribute to two results: a lower unit vacancy rate and increased cost burden for rental households.

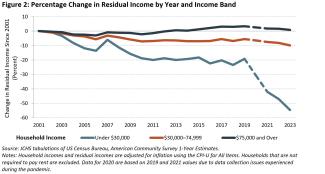

Rental vacancy rates declined in nearly 90% of the country’s largest markets and the percent of cost-burdened renter households hit 50% (27% are severely cost-burdened, spending more than half the household income on rent). In North Carolina, about 22.7% of rent households are moderately cost burdened and about 23.6% are severely cost burdened. Altogether, about 46.3% of renter households are cost burdened. These cost burdens, along with other economic factors, have led to low residual incomes—the amount families have after rent and utilities. Since the Covid-19 pandemic, residual incomes have seen sharper declines. Households making less than $30,000 a year have experienced the largest drop-off of residual incomes. Those households are left with a median residual income of just $250 to spend on other necessities and expenses (see Figure 2 below).

Worsening cost burden for rental households is that new construction of rental units includes mostly luxury and other higher-rent units. Moreover, the supply of low-rent rental units actually fell. In the decade from 2013 through 2023, the number of units with a monthly rent of $1,000 or less, after adjusting for inflation, decreased by more than 7 million units, or 30%. In that same decade, the supply of units with monthly rent equal to or greater than $2,000 increased by 5.5 million units, or 153% (from 3.6 million units to 9.1 million units). Looking forward, the supply squeeze of rental units is expected to tighten even more as the number of “new starts” of multifamily rental unit construction declined by about 14% in 2023 and then another 25% in 2024. For more on these trends in North Carolina, see the Agency’s fall 2024 blog, “North Carolina Loses Nearly One-Third of Low-Cost Rental Units Over the Last Decade.”

Homelessness

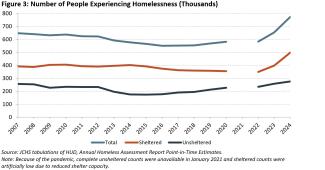

Not only are the costs and prices associated with rental housing and home ownership rising but the number of people experiencing homelessness also rose in 2024. During the Report’s release event, Daniel McCue, a senior research associate at JCHS and project manager of the Report, highlighted that “homelessness is surging. Homelessness is up 18% over the past year and 33% since 2020, totaling over three-quarters of a million people” [1]. Based on the US Department of Housing and Urban Development’s Point-in-Time estimates, the Report states that, in January 2024, more than 771,000 people experienced homelessness, with increases for both the sheltered and unsheltered numbers (see Figure 3 below).

This recent rise in the number of people experiencing homelessness aligns with the trend in North Carolina where there has also been an upward trend since 2022, if not earlier. For example, in 2024, North Carolina saw a 24% increase in the number of people experiencing homelessness compared to 2022 [1]. For a more thorough discussion regarding homelessness in North Carolina, see the Agency’s blog, “Newly Released Data Shows Homelessness in North Carolina and Nation is Trending Upward,” published earlier this year.

As the Report highlights, state and local governments play a pivotal role in providing the assistance that families need. The North Carolina Housing Finance Agency supports many programs helping provide quality affordable housing for current and future homeowners, renters and those experiencing or at risk of experiencing homelessness. Learn more about the Agency’s programs and other resources on its website.

Read the full report and access additional resources at State of the Nation’s Housing 2025.

________________________________________________________________________________________________________

[1] McCue, D. The State of the Nation’s Housing 2025. Joint Center for Harvard Studies. Video Link.

[2] NC Housing Finance Agency analysis of Point-In-Time Count data. Available here.