Recent research highlights the substantial gaps in meeting North Carolina’s housing needs, most notably in the low vacancy rates in affordable rental housing and limited number of affordable homes for sale. Commissioned by NC Chamber Foundation, NC Home Builders Association and NC REALTORS®, “2024 Housing Supply Gap Analysis, State of North Carolina” examined the housing supply and demand in North Carolina for 2024 through 2029, considering projected household growth, housing affordability, substandard housing conditions, commuting trends and job growth projections. Overall findings show an expected gap of 764,000 total units (322,000 rental units and 442,000 units for purchase).

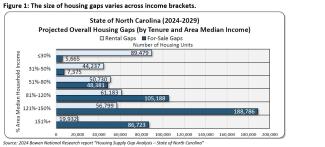

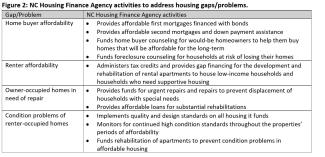

The report notes that “the housing gaps in this study could and should be addressed through some combination of new construction, housing repairs and weatherization, and by providing financial assistance to residents with severe housing affordability issues,”[i] all areas that the NC Housing Finance Agency seeks to address through its programs. According to the report, housing supply gaps impact all income groups, particularly the low- and moderate-income households targeted by the Agency’s programs. While the largest overall housing gap is for would-be home buyers with incomes in the range of 121%-150% of the area median income (AMI) (188,786 homes), home buyers earning 80% AMI or less also face a large gap of 61,421 homes. The divide for renters is highest (89,479 homes) for those with extremely low incomes (less than or equal to 30% AMI).

Rental vacancy rates overall are around 5%, with rates varying around the state. But there is 1.4% vacancy in Low-Income Housing Tax Credit (LIHTC) properties and 0.3% vacancy in government-subsidized housing for households earning less than 50% AMI. Tens of thousands of households are on waitlists for these properties (indicating high demand), and rural areas have particularly low vacancies (0% vacancy in multifamily rental properties in Jackson, Bladen, Hertford, Granville and Wilkes counties, among others).

North Carolina also has very low numbers of homes for sale. Whereas in a healthy home buying market 2%-3% of the units are available for purchase at any one moment, in North Carolina only 0.8% of the units are available (22,146 homes). These low availability rates occur in all regions of the state and are lowest in Greene, Caswell, Gates, Randolph and Yadkin counties, where 0.3% or fewer of the units are available. And of those limited number of homes for sale, the median list price for the state as a whole is $419,000 and out of reach for people with lower incomes. Only 2,324 homes in the state are priced below $200,000[ii].

While counties with the largest housing gaps tend to be more urban[iii], many rural or non-urban counties have disproportionately high housing deficiencies compared to the number of overall households. Chatham, Lee, Watauga, Montgomery and Pender counties rank among the top 10 counties in ratio of gap to households. Mecklenburg, Wake, Durham and New Hanover counties rank among the top 10 counties both in size of gap and in the ratio of gap to households.

What Can Be Done?

In recent years construction has averaged approximately 95,000 units per year[iv]. This would be insufficient to solve a gap of this size via construction alone. Solving this housing supply gap will require several approaches because, as this report demonstrates, there are shortages and problems throughout the housing ecosystem. The report provides a range of recommendations to address the gaps including:

- Educating the public and decision-makers on housing patterns and needs;

- Finding model approaches in other states and localities;

- Encouraging the development of local housing plans;

- Preserving existing affordable housing;

- Building local housing organizational capacity; and

- Utilizing the findings of the report to attract residential development.

Filling the gap identified in this report would bring sizeable economic benefits to the state[v]. In addition, providing the necessary affordable housing opportunities would meet a vital need for low- and moderate-income households, and would help bring about the social and economic benefits of housing covered in prior NC Housing Finance Agency blogs and publications[vi],[vii].

--------------------

[i] “2024 Housing Supply Gap Analysis, State of North Carolina” from Bowen National Research, page II-14. Available here.

[ii] “2024 Housing Supply Gap Analysis, State of North Carolina” from Bowen National Research, page IV-49. Available here. In only nine counties are more than half the units available for purchase priced below $200,000: Edgecombe, Martin, Washington, Anson, Scotland, Montgomery, Halifax, Bladen and Greene.

[iii] “2024 Housing Supply Gap Analysis, State of North Carolina” from Bowen National Research, beginning on page II-17. Available here. The report reports that 52.8% of the total gap in the state can be found in these 10 counties: Mecklenburg (14.6%), Wake (14.5%), Guilford (4.3%), Durham (4.3%), Forsyth (3.3%), New Hanover (2.8%), Buncombe (2.6%), Cumberland (2.3%), Union (2.0%) and Brunswick (2.0%).

[iv] NCHFA calculations based on building permit data 2021-2023 reported on page IV-52 of the report “2024 Housing Supply Gap Analysis, State of North Carolina”.

[v] 2024 Walden Economic Consulting publication “The Economic Impact of Closing the Housing Gap in North Carolina”, available here.

[vi] Benefits of Housing, available here, on how affordable stable housing benefits education, health, the economy, communities and children.

[vii] The Health Cost Savings of Quality Affordable Housing (2024), available here.