Buying a home is expensive. Saving the cash for a down payment is difficult. These hurdles are common and major barriers to home ownership, especially for low- or moderate-income families, even when they can otherwise afford and qualify for a mortgage. Down payment assistance (DPA) can help home buyers overcome this hurdle by providing monetary assistance through a loan or grant.

Down Payment Resource recently partnered with the Urban Institute to publish a report [i] combining DPA with Home Mortgage Disclosure Act (HMDA) data to analyze and review DPA programs and borrower statistics across the country as a special feature of the “Housing Finance at a Glance” monthly chartbook. This report reveals best practices in DPA programs and important trends in mortgage originations and denials that can help shape DPA programs within North Carolina and beyond.

What is Down Payment Assistance?

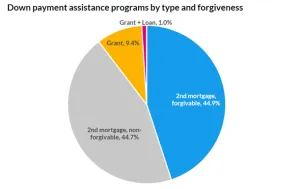

Broadly speaking, down payment assistance is a resource for potential home buyers to cover some or all of the costs of their down payment for a new home. The assistance often comes from government agencies, non-profits, community organizations and—sometimes—mortgage companies. Generally, DPA is a loan, grant or credit which can have various terms depending on the specific program or form of assistance, such as loan term, amount, interest rate, forgiveness, deferment, etc. As of August 2023, across the United States, the vast majority of programs offered their assistance as a second mortgage, with about 10% offering assistance as a grant. The below chart from Down Payment Resource further breaks these numbers down across the nation.

Source: Analysis by Down Payment Resource and Down Payment Assistance of DPA programs nationally.

Programs provide DPA either as a set dollar amount or as a percent of the property value. The median amount of set dollar amount assistance countrywide is $15,000, while the median percent of property value assistance is 22.1%.

According to Down Payment Resource, in 2023, there were about 1,676 active DPA programs in the country, for an average of just under 34 programs per state [iI]. The vast majority of these programs were offered by state housing finance agencies, local governments or nonprofits. North Carolina surpassed the national average with 39 programs, several of which are offered by the NC Housing Finance Agency.

How Can Down Payment Assistance Help?

Among other ways, DPA can assist by helping close the “cost hurdle” of affording a new home, by helping provide enough “cash to close,” by helping more home buyers qualify for loans by lowering their debt-to-income ratio and by providing sufficient upfront funding to avoid the need for private mortgage insurance.

Almost 70% of renters believe that affording a down payment is a barrier to home ownership and 36% find saving for a down payment to be “very difficult.”[iii] By providing financial assistance, often with favorable terms compared to a first mortgage or other loans, DPA offers potential homeowners an opportunity to overcome this barrier and allows them to access affordable mortgage loans. DPA also assists buyers in qualifying for a mortgage where they may otherwise be denied.

Potential home buyers who are otherwise ready and able to afford a home may refrain from applying for a mortgage due to lack of readily available financial resources. Even among those who do apply, many are denied due to having “insufficient cash to close” (CTC) or too high of a “debt-to-income ratio” (DTI). In the report, Down Payment Resource found that, in 2022, about 37% of denied mortgage applicants were denied due to DTI while another almost 6% were denied due to insufficient CTC. For those with incomes below 80% of area median income, over half of denials were due to one of these two reasons. DPA can help prevent these denials.

Regarding insufficient CTC, down payment assistance directly provides funds or cash that go towards part of the closing costs, increasing potential mortgage borrower’s available cash at closing. Meanwhile, by increasing the amount a potential borrower can use for a down payment, DPA reduces the amount of the associated mortgage principal. This, in turn, lowers the ratio between mortgage debt to income. By both providing funds and by moderating the DTI ratio, down payment assistance can help increase home buyer eligibility for a mortgage. Overall, Down Payment Resource found that over 42% of potential home buyers who had their mortgage application were potentially salvageable if they had made use of a DPA program.

How Does the NC Housing Finance Agency Help?

The NC Housing Finance Agency offers down payment assistance through a variety of the Agency’s home buyer programs. In 2023, the Agency assisted more than 5,400 home buyers, providing DPA to more than 4,200 of those households. The Agency offers three different DPA options to assist low- and moderate-income home buyers: The NC Home Advantage Mortgage™, NC 1st Home Advantage Down Payment and the Community Partners Loan Pool.

For both first-time and move-up home buyers, the Agency’s NC Home Advantage Mortgage™ provides qualified individuals with down payment assistance up to 3% of their mortgage loan amount. This down payment help is a 0%, deferred second mortgage, which is forgiven 20% per year at the end of years 11–15, with complete forgiveness at the end of year 15.

For first-time home buyers and military veterans who qualify for an NC Home Advantage Mortgage™, the NC 1st Home Advantage Down Payment offers $15,000 in down payment assistance. This down payment is also structured as a 0%, deferred second mortgage, which is forgiven 20% per year at the end of years 11–15, with complete forgiveness at the end of year 15.

The Community Partners Loan Pool program offers eligible low- and moderate-income home buyers up to 25% of the sales price, not to exceed $50,000 of down payment assistance, when paired with a NC Home Advantage Mortgage™. This CPLP DPA assistance may be combined with the $15,000 NC 1st Home Advantage Down Payment.

More information on the Agency’s down payment assistance and other home buyer programs is available on NC Housing Finance Agency’s website.

[i] A full copy of this publication of Urban Institute's Housing Finance at a Glance including the DPA special feature is available on Urban Institute's website.

[ii] Of those 1,676 programs, 25 operated nationwide or across state lines. After accounting for those 25 programs, the state average is about 33.

[iii] Goodman, L., et al. (2018) Accessing Homeownership With Credit Constraints. Urban Institue. Link.